EC HEALTHCARE (2138)

Commentary:

|

Stock: |

EC Healthcare |

|

1 Month H/L: |

4.71 – 8.18 |

|

Stock Code: |

2138.HK |

|

52 week H/L: |

3.95 – 11.356 |

|

Market Cap.: |

HKD 9.119B |

|

Listing date: |

11/03/2016 |

|

Stock Outstanding: |

1,181,230,189 shares |

|

Listing price: |

3.03 |

|

P/E (TTM): |

45.146 |

|

Chairman & CEO: |

Mr. Tang Chi Fai |

|

Dividend: |

0.10 (mid-term & end of year) |

|

Major Shareholdes: |

1. Tang Chi Fai – 61.29% |

|

Dividend Yield: |

1.295% |

|

|

2. OrbiMed Advisors III Ltd– 5.66% |

|

|

|

|

|

|

Established in 2005, the company was one of the well-known aesthetic medical service provider in Hong Kong. Operating under the brand name, DR REBORN, the brand developed into one of the popular aesthetic medical provider in Hong Kong. Building on their success of DR REBORN, the company began to diversify into medical, dental as well as other medical services. After series of acquisition and consolidation, the company's services are now composed of the following: Medical services, Aesthetic medical and beauty and welless services and Others. As at 30 September 2022, the company operated 154 services points in Hong Kong, Macau and Mainland China.

The company released its 2022 interim result (year ended on 30th September) on the 24th of November, the table below briefly summarised the company's performance:

|

Business segment |

Business description |

Remarks |

|

Medical |

Provide general practice, specialist services such as Orthopedic, dental services, eye care services, oncology , screening services and other medical specialist services. |

Revenue from this segement up 47.5% ,from HK$ 796M to HK$1,174.8M. However, the net profit of this segment showed 48.6% decline, from HK$119.7M down to HK$61.6M. This segment contributed 62.1% of the total revenue. |

|

Aesthetic medical and beauty and wellness |

Operate under various brand names, one of the most well-known is DR REBORN. |

Revenue from this segement down 2% ,from HK$ 619.7M to HK$607.4M. The net profit of this segment dropped 32.2%, from HK$94.5M down to HK$64.1M. This segment contributed 32.1% of the total revenue.

|

|

Others |

This services include: Veterinary care |

Revenue from this segement up 301.9% ,from HK$ 27.6M to HK$110.99M. The increase can be attributed to the newly acquired veterinary business. The net profit of this segment increased significantly from overloss HK$0.581M to HK$19.6M. This segment contributed 5.8% of the total revenue. |

Source: Company's annual reports and interim reports

Overall, the company's revenue was up 31.1% y-o-y to HK$1,893.2 M. However, EBITDA was down 16.6% y-o-y to HK$269.9M and the net profit was down 46.3% y-o-y to HK$105.2M. The decline could be contributed to the challenging condition including uncertainity in the global economy, indefinite re-opening time of the border and weak retail data due to persisting COVID-19. In terms of geograhic contribution, Hong Kong reported revenue HK$1,746.5M, up 33.2% y-o-y and representing approximately 92.3% of the group's overall revenue, while Macau reported revenue HK$ 56.8M, up 7.7% y-o-y and Mainland China had HK$ 89.8M, up 12.6% y-o-y.

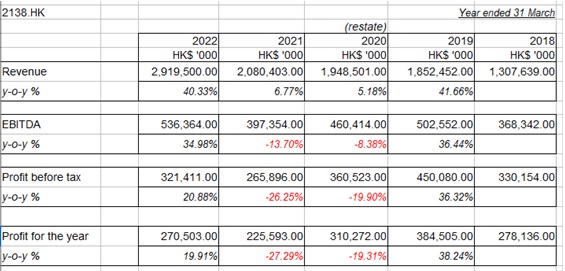

Overall financial summry of the company from 2018 to 2022:

Source: Company's annual reports

Companies comparison (14/12/2022)

|

Stock Code & Company name |

Market captialisation (HK$ Million) |

P/E |

Dividend yield (%) |

|

2138.HK EC healthcare |

9,119 |

45.15x |

1.30 |

|

1830.HK Perfect medical |

5,133 |

16.45x |

4.93 |

|

722.HK UMP healthcare |

634 |

8.565x |

5.63 |

|

1419.HK Human health |

759 |

2.02x |

15.0 |

投资涉及风险,有可能损失投资本金。你应该咨询专业人士,就本身的投资经验,财务状况,个人目标及风险取向,以提供投资意见。各类产品的风立,请参阅本公司网页http://www.phillip.com.hk「风险披露声明」。

辉立(或其雇员)可能持有本文所述有关的投资产品。此外,辉立(或任何附属公司)随时可能替向报告内容所述及的公司提供服务,招揽或业务往来。

以上资料为辉立拥有并受版权及知识产法保护。除非事先得到辉立明确书面批准,否则不应复制,散播或发布。