-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

FSE Lifestyle Services (331.HK) - Stable natural growth potential

Thursday, December 19, 2024  1909

1909

FSE Lifestyle Services(331)

| Recommendation | Accumulate |

| Price on Recommendation Date | $5.570 |

| Target Price | $6.000 |

Weekly Special - 3306 JNBY Design Limited

FSE Lifestyle Services (“FSE”) are a lifestyle services conglomerate with 3 major business segments: property & facility management services, city essential services and E&M services. FSE's services are being delivered through 8 major groups of companies which include Urban Group, Kiu Lok Group, Waihong Services Group, FSE Environmental Technologies Group, Hong Kong Island Landscape Company Limited, General Security Group, Nova Insurance Group and FSE Engineering Group. FSE offer comprehensive “one-stop shop” professional services to its clients who are engaged in a wide diversity of projects, including property developments, public infrastructures, education and transportation facilities, as well as entertainment and travel industries in Hong Kong, Macau and the Mainland China. FSE clientele includes the HKSAR Government, multinational corporations, owners and investors of properties, theme parks, universities, hotels and hospitals covering both private and public facilities.

Stable natural growth potential

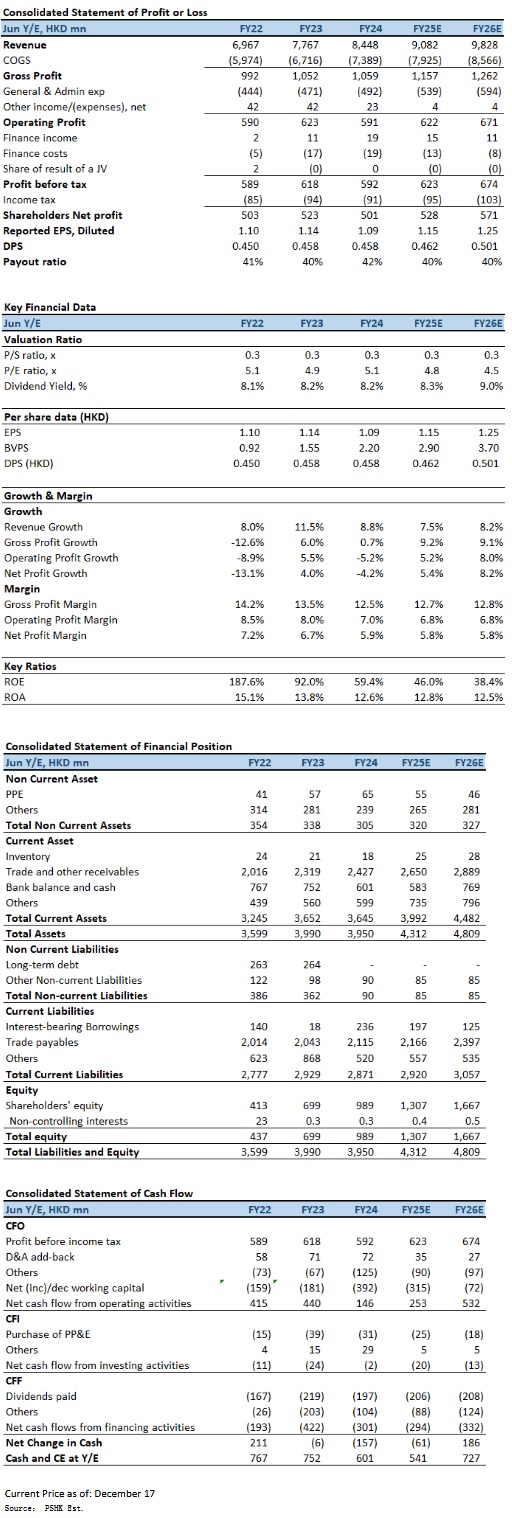

FSE's delivered a solid performance in FY2024, achieving revenue of HK$8,447.9 million, representing an 8.8% year-on-year (YoY) growth. This reflects the diversification of its business segments and the effectiveness of its operational strategies. Shareholders` profit stood at HK$501.1 million, a 4.2% decline YoY. Excluding the impact of government grants, the adjusted net profit was HK$475.3 million, up 6.6% YoY. During the period, basic earnings per share (EPS) were HK$1.09, down 4.4% YoY, while the total dividend per share was HK$0.438, maintaining a stable payout ratio of 40.0%.

In terms of gross profit, the overall gross profit margin declined from 13.5% in FY2023 to 12.5% in FY2024. This was primarily due to the reduction in government grants and the reduction in profit contributions from COVID-related works, particularly in the city essential services segment. Excluding government subsidies and other non-recurring items, the adjusted gross profit margin remained steady at 12.4%, demonstrating the resilience of the company's core business profitability.

By business segment, the city essential services segment remained FSE's core revenue driver, with revenue reaching HK$4,459.1 million in FY2024, up 18.4% YoY. Cleaning and pest control services saw significant growth, with revenue increasing by 35.7% to HK$2,349.6 million, reflecting contributions from newly signed service contracts. Additionally, revenue from Technical support & maintenance services grew by 10.1% to HK$1,060.0 million, driven by new projects such as the system replacement works at a commercial building in Tsuen Wan. Despite a decline in building materials sales, the segment's overall growth momentum remains robust. Looking ahead, as the Northern Metropolis and Kai Tak Development Area projects progress, demand for cleaning services and technical support is expected to increase further.

Revenue from the Property and Facility Management Services segment decreased by 6.4% YoY to HK$663.4 million, primarily due to the reduction in temporary COVID-related works. Nevertheless, the segment maintained a stable gross profit margin of 32.0%, reflecting the profitability of its core management operations. With the growing demand for professional property management services, the segment holds significant long-term growth potential. In particular, as Hong Kong's housing supply increases and urban redevelopment projects progress, the segment is likely to benefit from participation in more large-scale projects in the coming years.

E&M Services segment achieved revenue of HK$3,325.4 million in FY2024, representing a 1.0% YoY increase, mainly driven by contributions from the Hong Kong and Macau. While revenue from mainland China declined by 3.6%, the Macau recorded a remarkable 119.1% growth, reflecting a recovery in hotel renovation and infrastructure development demand. Looking ahead, the segment is expected to benefit from sustainable growth opportunities driven by Hong Kong's railway development, the Northern Metropolis projects, and the advancement of district cooling systems. In Macau, the recovery of the gaming industry and continued demand for hotel renovations will remain key revenue growth drivers.

As of 30 June 2024, FSE's outstanding contract value stood at HK$13,522 million, comprising HK$6,851 million from the city essential services segment, HK$5,786 million from the E&M Services segment, and HK$885 million from the Property and Facility Management Services segment. These contract reserves will provide strong support for the company's future performance, enabling it to benefit from sustained growth in the coming years.

Investment Thesis

FSE's maintained a healthy financial position as of June 30, 2024, with cash and bank balances of HK$601.3 million and a net cash position of HK$365.5 million. Combined with its leading position in the industry and strong growth momentum, we expect FY2025E-FY2026E EPS to be HK$1.15 and HK$1.25 respectively, with PT of HK$6.00, implies a FY2025E P/E of 5.2x (~5-yrs historical average). Our investment rating is “Accumulate”.

Risk factors

1) Intensifying industry competition; 2) Sharp increase in operating costs; and 3) Unexpected slowdown in service demand.

Financial

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|