-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

A-Share Research Report

The articles are produced in Chinese only.

Author

章晶小姐 (Zhang Jing)

高級分析師

高級分析師

本科畢業於同濟大學工科,碩士畢業於華東師範大學金融貿系。現為輝立証券持牌高級分析師,主要負責汽車及航空板塊的研究,曾獲得《華爾街日報》亞洲區2012年度汽車及零部件最佳分析師第二名,擅長將行業前景與上市公司結合分析。

Bachelor Degree in Tongji University of Engineering; Master Degree in East China Normal University of finance. Currently cover automobile and air sectors. Having worked in research for years and is good at combining analysis for the companies with industry prospects.

| Phone: | 86 21 51699400-103 | Email: | zhangjing@phillip.com.cn | |

Spring Airlines (601021.CH) - Low-cost Advantage Continues to Thrive in a Booming Industry

Friday, February 2, 2024  5965

5965

Spring Airlines(601021)

| Recommendation | BUY |

| Price on Recommendation Date | $52.350 |

| Target Price | $65.000 |

Company Profile

Spring Airlines (hereinafter referred to as the "Company") is the leader of low-cost airlines in China, founded in 2004 and based in Shanghai. It adopts a single aircraft model (i.e., the Airbus A320 family) and only offers the economy class. The Company raises its passenger load factor (P L/F) mainly by attracting travellers through its parent company, Shanghai Spring International Travel Service Ltd. (Shanghai Spring Tour), offering charter flights through its subsidiaries, and providing special fares. Meanwhile, it enhances the aircraft utilisation rate to obtain a remarkable cost advantage by optimising the route structure, prolonging flight time, and accelerating turnover.

Investment Summary

Record-breaking Profits in Peak Season, Doubling Compared to Pre-pandemic Period

In the third quarter of 2023, Spring Airlines recorded a revenue of RMB6,072 million, up 105.75% yoy and 37.5% compared to the third quarter of 2019. The net profit attributable to the parent company reached RMB1,839 million, a yoy increase of RMB2,331 million compared with a loss in the same period of 2022 and a 113% increase compared to the third quarter of 2019, which tied all the profit of 2019. Both revenue and profit for the third quarter hit a new high for a single quarter since the listing, demonstrating the profit elasticity in a booming industry. The Company reported an accumulated revenue of RMB14,103 million in the first three quarters of 2023, up 113.52% yoy. Its net profit attributable to the parent company stood at RMB2,677 million, up 55.7% compared to the same period of 2019, while there was a loss in the third quarter of 2022. The recovery progress since this year is far beyond our expectations.

Outperforming Operation Data in Comparison to Peers

Industry data indicates that in the third quarter of 2023, the domestic aviation industry completed 3,409 thousand flight hours, up 73.4% yoy and 7.1% compared to the same period in 2019. There were 1,373 thousand aircraft movements accumulatively, up 65.7% yoy and 5.5% compared to the same period in 2019. As a leader in domestic low-cost aviation, Spring Airlines stands out in its cost control and differentiated operation capabilities. Meanwhile, its recovery progress outperforms peers, benefiting from the Company's breakthroughs in second-tier airports and network expansion in lower-tier cities. In the third quarter, Spring Airlines` RPK exceeded that in the same period by 18.7%. Specifically, domestic, international and regional routes recovered to 154.5%, 49.7% and 48.6% of their levels in 2019, respectively.

With respect to transport capacity, in the third quarter, the Company's ASK increased by 16.2% qoq and up 18.9% over the same period in 2019, with domestic growth of 54.5% and international and regional decreases of 50.3% and 51.4%, respectively. Spring Airlines purchased six aircraft and discarded zero during the first nine months, amounting to a net introduction of six. As of the end of September, the Company has been operating a total of 122 A320 aircraft. Spring Airlines possesses an industry-leading P L /F. In the third quarter, its average P L /F was 91.8%, up by 2.9 ppts qoq and only down by 0.15 ppts compared to the same period in 2019. The gap has been narrowing season by season compared to the pre-pandemic level, with domestic and international decreases by 0.3 ppts and 4.4 ppts over the same period in 2019, and an international increase by 9.1 ppts, respectively.

Low-cost Advantage Continues to Thrive in a Booming Industry

Thanks to the upsurging demands for domestic aviation during the peak summer season in 2023, the Company's RPK for the third quarter was RMB0.48, with a yoy increase of 16% over the same period of 2019. If the impact of fuel surcharges was not taken into consideration, the increase was around 7%. The Company's cost control capabilities remained outstanding, with an operating cost per ASK of RMB0.31, up 5.8% compared to the same period in 2019. Such an increase was mainly attributed to the rise in the average prices of jet fuel and the constraint of aircraft utilisation rate due to the pilot shortage, which has not yet returned to the levels of the same period in 2019. It is estimated that if the higher oil prices are excluded, the unit cost excluding oil is already lower than the pre-pandemic level. The combination of cost advantages and a simultaneous increase in passenger volume and prices has propelled the Company's profitability to a new high in the third quarter, with a gross margin of 31.1% and a net profit margin of 30.3%. In addition, the utilisation of tax shields has increased the net profit margin by approximately 5.9 ppts.

As for the outlook, according to the Report on 2024 Spring Festival Travel Rush Trend issued by Tongcheng Travel on 18 January 2024, the combination of visiting relatives and tourism during the Spring Festival travel rush is expected to drive strong demand for private travel. At the same time, the visa waiver policies of certain countries provide convenience for outbound tourism, and the new regulations on ticket refund and rescheduling by airlines effectively reduce the cost of travel for passengers, further stimulating the demand for air travel. It is noteworthy that the resumption of direct flights between China and the United States is expected to accelerate in 2024, which may contribute to the recovery of the international market supply and demand. Furthermore, supply chain issues with Boeing and Airbus may potentially slow down the industry's capacity recovery. However, such a supply-demand structure remains favourable for sustained high prosperity in the industry. For Spring Airlines, in the winter and spring flight seasons of 2023, its route time grew by 38.42% compared to the same period in 2019, and it is expected that the aircraft utilisation rate will further improve with the recovery of international transport capacity and the expansion of the pilot workforce.

Investment Thesis

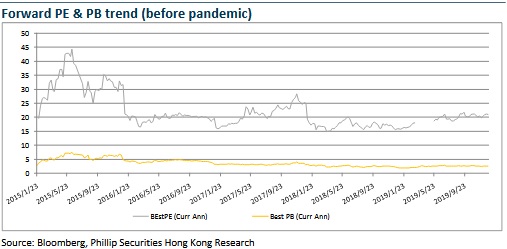

In the past two years, Spring Airlines has exceeded the industry average in terms of capacity expansion. By virtue of its excellent cost control and operating capacity, it has snatched market shares despite headwinds, which is reflected in its recent financial performance. Looking ahead, through the business model of low-cost aviation, the Company is expected to keep developing the mass aviation market and boasts its prominent competitiveness in sightseeing and low-cost business trips. There is still adequate momentum for future growth. Recently, the Company's stock price has been affected by various unfavourable factors such as Ashare market plummet, sustained increase in fuel prices, and RMB depreciation pressure. As a result, its stock price has undergone a continuous adjustment, thus we think the risks have been largely released. We believed that the stock price has entered a range of undervaluation.

We revised the estimate for net profit for 2023/2024 and introduce forecast for 2025, respectively, with the corresponding EPS being RMB 2.34/3.42/4.12 yuan. We lift the Company's target price to RMB 65, respectively 19 x P/E, for 2024, a "BUY" rating. (31 January)

Risk

Business cycle risk

Risk of jet fuel price fluctuation

Public health outbreak risk

Exchange rate fluctuation risk

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

- Friendship Links

- HKEX

- CNFOL HK

- Tencent HK

- SSE

- SZSE

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|

Contact Us

Research Department

Tel : (852) 2277 6846

Fax : (852) 2277 6565

Email : businessenquiry@phillip.com.hk

Enquiry & Support

Branches

The Complaint Procedures

About Us

Phillip Securities Group

Join Us

Phillip Network

Phillip Post

Phillip Channel

Latest Promotion

Phillip Securities Group

Join Us

Phillip Network

Phillip Post

Phillip Channel

Latest Promotion