-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Xiaomi (1810.HK) - Short-term performance is under pressure; Expect some relief in later period of second quarter

Thursday, July 21, 2022  998

998

Xiaomi(1810)

| Recommendation | Buy |

| Price on Recommendation Date | $12.780 |

| Target Price | $16.240 |

Weekly Special - 3306 JNBY Design Limited

Investment highlights

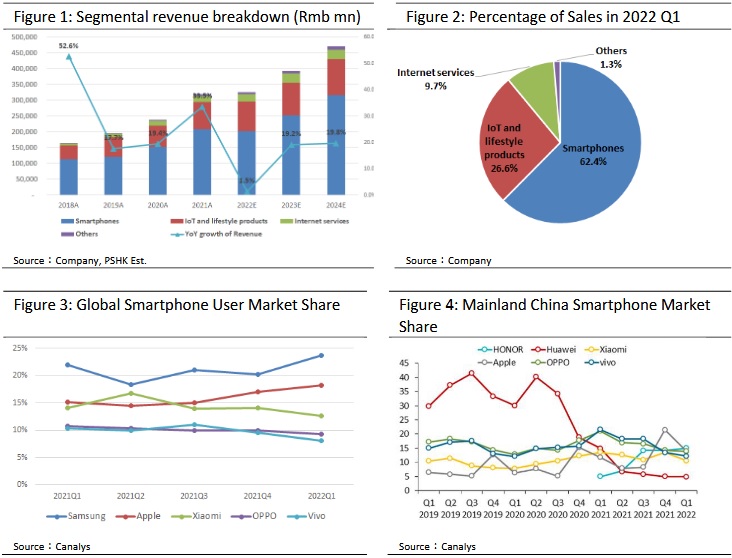

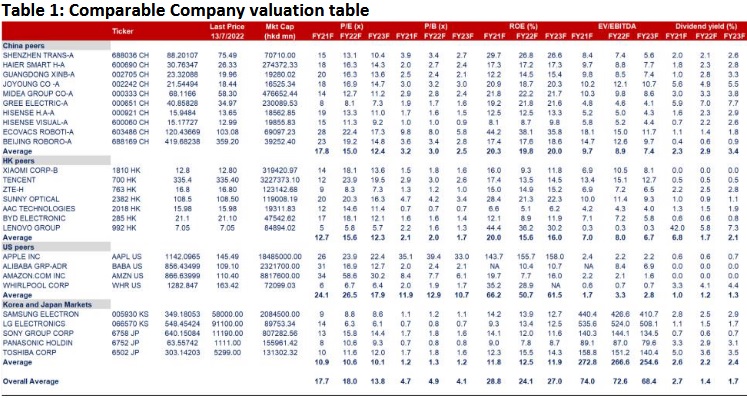

Xiaomi Corporation released its first quarterly report that the company's revenue was RMB73.4 billion, a decrease of 4.6% YoY; The gross profit was RMB12.7 billion, a decrease of 10.2% YoY; Adjusted net profit was RMB2.9 billion, a decrease of 52.9% YoY. In the first quarter of 2022, due to the supply shortage of key components, the domestic lockdown caused by the epidemic and the impact of the global economic environment, the shipments of smartphone business dropped sharply. However, thanks to the premiumization strategy of smartphones, the decline in shipments was partially offset by the increase in average selling price (ASP); As for the IoT and lifestyle products business, smart TVs, laptops, smart home and smart wearables all maintained rapid growth. Revenue from Internet services remained stable and the global and mainland China MAU of MIUI continued to grow. In general, the demand for smartphones in the first quarter of 2022 was weak. IoT and lifestyle products business was negatively affected. Internet service business maintained steady growth. At the same time, the company will continue to increase investment in research and development of electric vehicle in the next 1-2 years which may cause a negative impact on the company's overall profitability.

Supply shortages of key components for smartphones; competition intensified; shipments in the next quarter will still be affected

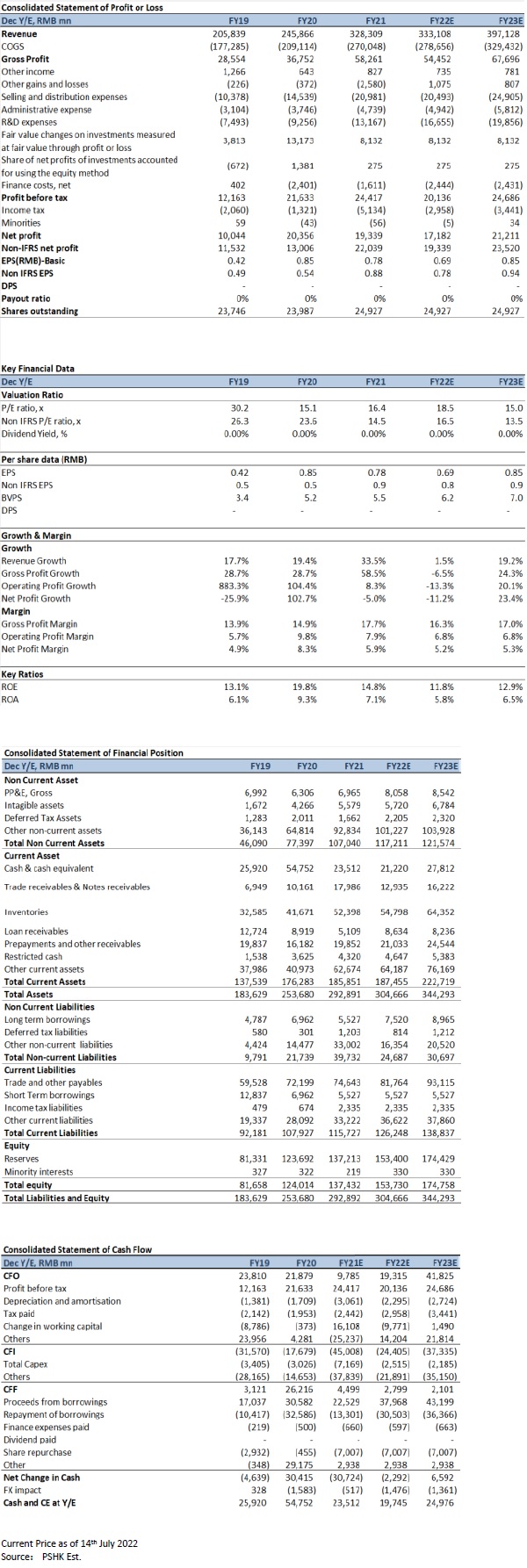

Revenue from the smartphone business in the first quarter was RMB45.8 billion, a decrease of 11.1% YoY, mainly due to the continued shortage of key component supply, the resurgence of COVID-19 and the impact of fierce industry competition. The gross profit margin of the smartphone business was 9.9%, down 3 percentage points YoY, mainly due to the promotion of certain smartphone models. The company's global smartphone market shipments in the first quarter of 2022 were 38.5 million units, a decrease of 22.1% YoY. The shortage of key components such as mobile phone chips has largely restricted the shipments of Xiaomi's mobile phones. The management stated that shortage of 4G chips has a great impact on Xiaomi and the shortage of Xiaomi's models below US$150 exceeded more than 10 million units. At the same time, thanks to the increase in the proportion of Xiaomi's high-end smartphone shipments, the global smartphone ASP reached RMB1,189, an increase of 14.1% YoY. The decline in shipments was partially offset by the increase in ASP.

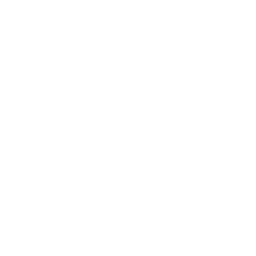

According to Canalys, as for global market, the global overall smartphone market shipments fell by 10.5% YoY in the first quarter of 2022. Xiaomi's global market share was 12.6%, ranking No. 3. In the Latin American market, the company's smartphone business and carrier business have great potential for development and the growth rate continues to increase, which is Xiaomi's growth point of this and next year. In addition, 4G equipment is more widely promoted into the African market, which is also another market with great development potential. As for domestic mobile phone market, according to Canalys, Xiaomi's market share is 13.9%, ranking No. 5. Although most leading suppliers have slowed down the pace of new product releases in the first quarter, Honor ranked No.1 with a market share of 20% in the first quarter of 2022 and competition among smartphone providers remains fierce.

The company's high-end smartphones accounted for more than 50% of the domestic offline shipments. The epidemic has affected the company's offline store traffic and offline consumer demand was sluggish. In March 2022, MAU of MIUI in Xiaomi's global and mainland China both reached a record high. MAU of MIUI in global reached 529 million, an increase of 24.4% YoY; MAU of MIUI in mainland China reached 137 million, an increase of 14.3% YoY. In terms of product research and development, company continues to expand its smartphone product line and develop new products, among which Xiaomi 12 series, Redmi K50, Redmi K50 Pro and the newly launched Xiaomi Civi 1S all accounted for more than 50% of new users. Although the supply of key components was tight in the first quarter of this year and the macroeconomic headwinds, geopolitics and industry competition were still challenging, the supply chain may improve in the second quarter. It is expected that the 618 shopping festival may partially help increase the shipments in the corresponding quarter.

IoT and lifestyle products business are negatively affected by logistics, inflation and rising costs and are expected to resume stable growth after the epidemic eases

The revenue of the IoT and lifestyle products business in the first quarter was RMB19.5 billion , an increase of 6.8% YoY. The gross profit margin of the IoT and lifestyle products business was 15.6%, an increase of 1.1 percentage points YoY, mainly due to the price decline of key components such as display panels. In the first quarter of 2022, the number of connected devices on AIoT reached about 478 million, an increase of 36.2% YoY; In terms of smart TVs, the global smart TV shipments in the first quarter of 2022 reached 3 million units, an increase of 15% YoY, ranking No.5 in the world. The YoY increase in the gross profit margin of the smart TV business in this quarter was mainly attributable to the cost advantage brought about by economies of scale and the price decline of key components; Smart devices maintained a good growth momentum. Since the release of the Xiaomi Pad5 series in August 2021, the shipment volume have exceeded 2 million units, ranking the top three in the first quarter in mainland China. In addition, the revenue of smart home (air conditioners, refrigerators, washing machines) in the first quarter increased by 25.0% YoY. The company will continue the high-end product market penetration strategy and launch new products this year, such as smart air conditioners and 630-liter super refrigerator series; Smart wearables continued to maintain its leading edge. Global shipments of TWS ranked No.3 in the first quarter and its domestic shipments ranked No.2. At present, the increase in overseas shipping logistics costs, inflation in Europe and the United States, the exchange rate impact caused by the conflict between Russia and Ukraine, and uncertainties in the overseas macro environment are the main challenges for the future growth of IoT and lifestyle products business. Gross profit of IoT and lifestyle products business is expected to increase in the second quarter. On the one hand, it is mainly due to the reduction in the cost of key components, such as the benefit of TV categories; On the other hand, newly launched household appliances are products with high gross profit margins, which are expected to improve overall gross profit in the future.

Internet service business maintains steady growth

Revenue from the Internet service business in the first quarter was RMB7.1 billion, an increase of 8.2% YoY. Gross profit margin was 70.8%, representing a decrease of 1.6 percentage points YoY, mainly due to the increase in the proportion of revenue of certain advertising businesses with lower gross profit margins. In the first quarter of 2022, the scale of global and domestic Internet users will maintain a growth trend. Revenue of advertising business reached RMB4.5 billion with an increase of 16.2% YoY, mainly due to the increase in search, performance and brand advertising business revenue. The revenue of game business reached RMB1.1 billion, an increase of 3.0% YoY. The lower growth rate was mainly due to challenges from the regulatory environment and macro economy. In overseas markets, the revenue of overseas Internet service business reached RMB1.6 billion in the first quarter of 2022, an increase of 71.1% YoY. The proportion of overseas markets in overall Internet service revenue continued to increase to 21.9%, reaching a record high. In the domestic market, TV advertising revenue of China's TV Internet service in the first quarter accounted for 15.0% of the total domestic Internet service revenue, reaching a new record. Due to the high installed capacity in China, TV advertising and TV added value-added are expected to bring revenue growth in the future.

Company Valuation and investment advice

Compared with companies in the same industry in domestic and global, Xiaomi's current PE ratio is only about 14×, which is lower than the industry average; due to the impact of the domestic epidemic and the macroeconomic headwinds, rising costs and logistics costs in the first quarter affected smartphone business and IoT and Consumer products business. Besides, the automotive business will also affect profits in the nearly 1-2 years. The epidemic is expected to ease in the second quarter and the 618 shopping festival may improve the smartphone business and IoT and lifestyle products business in the corresponding quarter. We predicted the company's adjusted net profit per share in 2022-2023 to be RMB0.78 and RMB0.94 respectively. We set our target price at HK$ 16.24, corresponding to 18.0× and 14.8× PE ratio in 2022-2023 and our investment rating is "Buy" .

Risk factors

Uncertainties in the epidemic resurgence; continued supply shortage of key components such as chips; macroeconomic headwinds; intensified competition in the industry

Financial data

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|