-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Report Review of March 2022

Friday, April 8, 2022  5382

5382

Report Review of March 2022

Weekly Special - 3306 JNBY Design Limited

Sectors:

Air & Automobiles (Zhang Jing),

TMT, Semiconductors, Consumer & Healthcare (Eric Li)

Automobile & Air (ZhangJing)

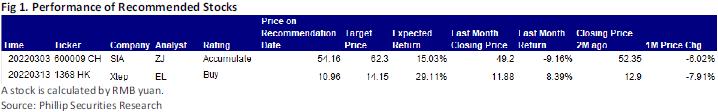

This month I released an updated reports of Shanghai International Airport (600009.CH).

Under the influence of the pandemic, the passenger throughput of airports in China reached 907 million in 2021, an increase of 5.9% over 2020, and a recovery of 67.1% in 2019, which was a 32.9% decline compared to 2019. On a closer look at markets, due to the Spring Festival travel policy and the repeated sporadic outbreaks in China, the low point of aviation demand for domestic routes appeared in February, August and November, and the high point was in March, April, May and July. As the Civil Aviation Administration of China enforced strict control over the cases imported from overseas, the number of international and regional flights has always hit a trough, with small fluctuations throughout the year. Compared to 2019, the monthly number of international and regional flights has dropped by more than 90%. Only the number of flights in April and July increased slightly compared to 2020.

Compared to other airports in China, Shanghai Pudong International Airport is more dependent on non-aviation revenue such as international routes and duty-free business rentals in terms of results. Therefore, the sharp drop in international passenger traffic has a greater impact on the airport's results. According to the result forecast released on 24 January 2022, the Company predicted losses in 2021 could reach RMB1.64 billion to RMB1.78 billion. The corresponding loss from Q1 to Q4 was RMB436 million, RMB304 million, RMB510 million and RMB390-540 million. The annual tax-free revenue was expected to approach RMB500 million, a decrease of nearly 90% compared to nearly RMB5 billion in 2019.

According to the announcement, SIA signed an agreement with the holding major shareholder SAA, in which the transaction price of 100% equity of the underlying asset Hongqiao Airport is approximately RMB14.5 billion, the transaction price of 100% equity of the logistics company is approximately RMB3.1 billion, and the transaction price of No.4 Runway in Pudong Airport is approximately RMB1.5 billion, with a total of approximately RMB19.1 billion. The listed company is expected to issue approximately 434 million shares to SAA at a price of RMB44.09 per share. Meanwhile, the Company will issue no more than approximately 128 million targeted additional shares to SAA. The scale of supporting financing will be reduced to no more than RMB5 billion.

We think that Hongqiao Airport, which mainly engages in domestic routes, has quick business recovery. In the long run, it has good development prospects and strong profitability. The injection into the listed company will realise the re-integration and optimization of route resources. Affected by the pandemic, Pudong Airport, which mainly focuses on international routes, has high operating costs. In order to utilize resources more rationally and efficiently, Shanghai Airport has tried to divert a large number of idle international time resources to the domestic market, so that the passenger flow of Pudong Airport will recover faster. In addition, the reorganisation will also incorporate the logistics and cargo business, which will help improve the air cargo hub network, expand multimodal transportation, and optimize the cargo layout of Hongqiao Airport and Pudong Airport.

TMT, Semiconductors, Consumer, Healthcare (Eric Li)

This month I released an updated report of Xtep International (1368.HK).

Xtep announced a positive profit alert, and is expected to record a significant increase of not less than 70% in its consolidated profit attributable to ordinary equity holders for the year 2021 as compared to that for the year 2020.

In addition, Xtep also announced the operation data of 4Q2021. Xtep's core brand products retail sell-through (including offline and online channels) grew by 20%-25% (mid-teens growth in 3Q2021), retail discount level stayed at 25%-20%, and inventory turnover was about 4 months, which was flat QoQ. The core brand products retail sell-through increased by more than 30% in 2021, which was better than a high single-digit growth in the same period last year. The inventory turnover was about ~4 months, better than ~5 months in 2020.

A strong increase in consolidated revenue for the 2021 driven by: (1) an over 30% growth in core Xtep brand's revenue in second half of 2021 due to robust sales orders from distributors following our successful launch of signature functional and lifestyle products and retail channel upgrade during the Year; (2) accelerated revenue growth of the core Xtep brand's e-commerce and kids` businesses given the respective completed restructurings from branding, products to operations. An expansion in the gross profit margin of the core Xtep brand primarily attributable to (1) our continual effort in product innovations and better product offerings; and (2) a lower base of comparison triggered by the one-off inventory buy-back in 1H2020.

Management mentioned an accelerated growth in FY2021E, which was a result of core brand channel upgrades, ramp up of 9th generation stores, focus on retail experience & launch brand story, which increasing the associated purchase rate and sales per unit area. Xtep's ASP continued to rise as product and brand upgrades, including the launch of professional running shoes such as 160X and 260X series, and premium XDNA apparel such as the cross-over with Shaolin. In addition, kids/online grew faster after the completion of restructuring.

Management also mentioned that Product sold-out rate remained robust, with 1Q2021 and 2Q2021's >80%, 3Q2021's close to 80% and 4Q2021's close to 60%. The RSV growth momentum remained from Jan to date, discount & channel inventory remained at a healthy level.

Management noted that this strong growth momentum should have continued into 2022 year-to-date, as the 1Q-3Q22 procurement orders from distributors witnessed ~30% YoY growth. Management expects the core brand topline growth will be >30% in 1H22 and >25% for 2022 as the base is relatively high in 2021H2. Revenue growth for athleisure brands (K-Swiss, Palladium) and professional sports brands (Saucony, Merrell) to reach at least 30% and 50% respectively, in 2022.

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|