-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Report Review of April. 2022

Wednesday, May 18, 2022  1421

1421

Report Review of April. 2022

Weekly Special - 3306 JNBY Design Limited

Sectors:

Air & Automobiles (Zhang Jing),

TMT, Semiconductors, Consumer & Healthcare (Eric Li)

Automobile & Air (ZhangJing)

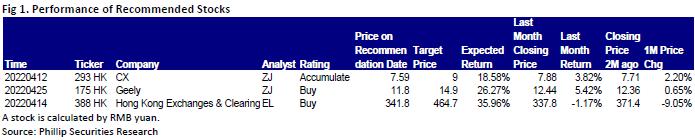

This month I released 2 updated reports of Cathay (293.HK),and Geely (175.HK) which got attention by their unique Competitive edge.

Automobile:

According to the released sales data, Geely's 2022Q1 cumulative sales volume was 326,024 units, down 2.26% yoy. Geely completed 19.8% of the annual target of 1,650 thousand units. The overall growth was below the industry average. We think that the main reasons are listed as follows: 1) The dilemma of chip shortage (such as body electronic stability system (ESP) chips) has not been got rid of. 2) The Chinese Spring Festival holiday in 2022 was earlier than the previous year. 3) With a small proportion of new energy models, the Company has not fully enjoyed the booming prosperity of new energy vehicles.

On a closer look at brands, Geely brand's high-end models of `China Star series` (Xingrui, Xingyue, and Xingyue L) recorded a sales volume of 25/14/21.6 thousand units, respectively in Jan/Feb/Mar, accounting for 17.1%/17.8%/21.35% of the total sales, respectively. The proportion saw a further increase. The premiumization of Geely brand was steadily advancing.

In October 2021, Geely released its hybrid power technology: Leishen Power. Leishen Hi-X, the Leishen intelligence engine, highly integrates one power generation motor, one drive motor, two motor controllers and 3-speed hybrid transmission, with the advantages of low fuel consumption, strong power, and long endurance. It reduces fuel consumption by 40%, and has a NEDC rating as low as 3.6L/100km, which is 0.4-0.6L lower than the Japanese HEV. In the future, it can match different models graded at A0-C, and adapt to full hybrid systems such as HEV, PHEV, and REEV. Relying on its CMA, BMA, SPA and SEA architecture platforms, Geely plans to launch more than 25 new smart new energy models in the next five years, including ten models of Geely brand, five models of Geometry, five models of LYNK&CO, and five models of new battery swap-enabled travel brand. New models equipped with Leishen Power launched in 2022 include LYNK&CO 01 HEV/PHEV, 03 HEV, 09 PHEV, 05 PHEV, Emgrand L HEV, and Xingyue L HEV/PHEV. We think that the launch of Leishen Power is significant for Geely, which not only makes up for the shortcomings in smart HEV, but also takes the first step of the "Smart Geely 2025" strategy, facilitating the realization of the objective of "Smart Travel Technology Enterprise".

Since 2021Q4, the Geely's share price has tumbled by 60%, mainly reflecting market concerns about the profit erosion of downstream manufacturing by rising raw material prices or subsidy declines. From Feb 2022, it has been dragged down by the potential impact of political conflicts. We think that Geely is relatively less affected by rising costs due to the model structure and excellent cost control. In 2021, the Company exported only 2% of vehicles to Russia, with limited risk exposure. Factors such as the chip shortage caused by the pandemic are expected to gradually improve or eliminate from 2022, and the long-term competitiveness and growth momentum remain unchanged.

Air:

Due to the escalation of the Omicron variant, the Hong Kong government tightened the travel and operation restrictions at the beginning of the year, and tightened the quarantine arrangements for crew members. Cathay Pacific's operating data for the first two months of 2022 bottomed out again. However, after mid-March, driven by the continuous decline in new confirmed cases and the gradual easing of the pandemic, the Hong Kong government said that it would suspend the compulsory testing for the whole people, and announced the cancellation of the ban on flights from nine countries, including the United Kingdom and the United States, from April 1. The Company's results were greatly affected by the pandemic control. Once the control is over, the rebound under the recovery of demand will also be large. At present, the corresponding price-to-book ratio of the stock price is less than 0.7 times, which is the lowest point in the past 20 years.Based on the revised financial forecast, we lift target price to HK$9 for the Company, equivalent to 2022/2023/2024E 0.82/0.79/0.77 x P/B.

TMT, Semiconductors, Consumer, Healthcare (Eric Li)

This month I released an updated report of Hong Kong Exchanges & Clearing (388.HK).

HKEX reported 4Q2021 revenue of HK$4.73bn, -7.2% YoY and -10.9% QoQ. Shareholders` net profit was HK$2.67bn, down 8.6% YoY, 17.8% QoQ, slightly below the consensus estimates. Although 2021 started exceptionally well, 1Q2021 with record quarterly Headline ADT of $224.4bn, 2Q2021 & 3Q2021 ADT both higher than the same period in 2020. However, amid continuing market volatility in 2021 and a slowdown in 4Q2021. The ADT 4Q has dropped to 126.4bn, down 24% YoY. In addition, Derivatives ADV decreased by 17% and ADT of Northbound Trading of Stock Connect decreased by 20%, resulting in trading and clearing fees decline in 4Q. Operating expenses decreased by 7.8% YoY, due to lower staff expenses. This led to EBITDA margins broadly flat as 74%. The IPO pipeline remained very robust, with the demand of US-listed Chinese companies homecoming listings in Hong Kong, as well as the introduction of a listing regime for SPACs and the enhanced listing regime for overseas issuers. However, numerous challenges posed by uncertainty surrounding the continued inflationary pressure, the tightening of the Fed's monetary policy, the entry of interest rate hike cycle, ongoing geopolitical risks and the pandemic recovery.2021 review, with a total of 98 company listings raising HK$331.4bn, down from the strong 2020 (154 company listings raising HK$400.2bn) and 5% higher than 2019 (HK$314.2bn). During the year, 59 new economy companies, including 31 Weighted Voting Rights (WVR), healthcare and biotech firms (including Chapter 18A listings only) and/or secondary-listed companies, accounting for 88% of IPO funds raised in Hong Kong during the period. Total market turnover in 2021 reached HK$41.2 trillion, up 28% compared with 2020. Total turnover of securitized derivatives (DWs, CBBCs and Inline Warrants) reached HK$4,956.8bn, up 8% compared with 2020. As world metal trading remained under pressure, the chargeable average daily volume of metals contracts traded on the LME decreased by 4% from 2020.

Overall, HKEx has continued to make a good progress in enhancing competitiveness and attractiveness of HK markets, with new product offerings across asset class, as well as a range of new market enhancements.

However, the ongoing pandemic and the macroeconomic environment is full of challenges. In particular, the United States named China's largest chip manufacturer SMIC (0981) last year to consider imposing tougher sanctions on China's largest chip manufacturer. SenseTime Group (0020) was also banned by the United States. U.S. Department of Commerce also plans to add more mainland biotech and medical companies to a so-called entity list, which bans the companies from key U.S. exports because they pose national security risks. In addition, the United States has passed legislation that if a foreign company U.S.- listed for failing to adhere Holding Foreign Companies Accountable Act that the act would allow the SEC to delist Chinese companies from U.S. exchanges it American regulators cannot review audit for three consecutive years; and the Securities and Exchange Commission (SEC) has earlier confirmed that 11 companies were included in the provisional list. Although this may lead to more US-listed Chinese companies homecoming listings in Hong Kong, but due to high transaction costs, and restrictions to investing on Chinese mainland companies, overseas funds and investors may not able to invest in HK-listed Chinese securities. Continued geopolitical tensions and macroeconomic risks, global investors may further reduce their investment in Chinese and Hong Kong companies, and even lead to massive capital outflows.

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|